Westpac Youth Banking

Equipping teenagers to effectively manage their personal finances

Overview

Westpac is one of Australia's "Big 4" banks and is Australia's first and oldest banking institution. This project was a client team project as part of the Academy Xi UX/UI Design Transform course.

Role

UX/UI Designer

User Research, User Interviews, Rapid Prototyping, Wireframing, Usability Testing

Background

Westpac Youth is an online banking app offering teenagers aged 12-18 years old everyday transaction and Bump Savings accounts to learn and practice personal financial management. This need arises as such teenagers start their first part-job, obtain loans for tertiary education, or pursue financial goals more broadly.

Project Objectives

Primary Objectives

Determine what type of product and experience is best suited for a young person new to banking

Understand and prototype the best way for a new young person to manage their personal finances

Understand the customer journey map, and motivations and drivers to manage personal finances

Secondary Objectives

Identify the demographics of users who would be interested in this product

Determine if users would be willing to interact with the product and why

Identify key stakeholders

Determine the most useful and dynamic way of engaging with the targeted audience

Problem Statement

Young Australians, aged 12-18, aren't excited about banking. We need to create a unique and compelling experience for this segment with a focus on being remarkably helpful in life's big and small moments.

Discover

Research

Working collaboratively, our research consisted of 5 categories:

Company

Competitors

Customers

Category

Climate

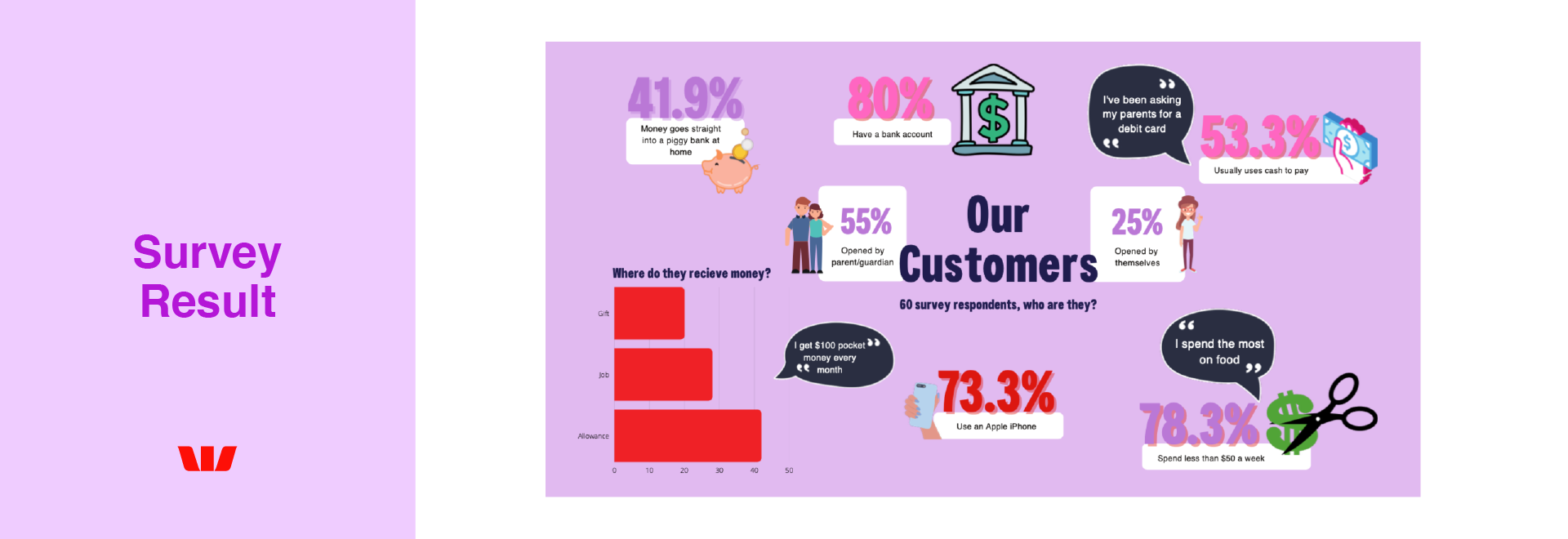

Research concerning Company, Competitors and Climate was conducted through desktop research. Research concerning Customers and Category was conducted through online surveys (66 respondents) and 1-on-1 interviews (22 interviews).

Results of our research is below:

Define

Affinity Map

Of the twenty-two 1-on-1interviews conducted, 18 were students (12-18 years) and 4 were mothers. Questions posed to each student included their life’s big and small moments, spending behaviour and challenges encountered when saving.

Key insights derived from the 1-on-1 interviews conducted with the students included:

Their life’s big and small moments mainly revolved around their life as a high school student, such as their commute to school with their friends, completing their school work, attending their high school formal and obtaining their driver’s licence

When asked, “If you were given $100 right now, what would you do?”, so as to derive insight into spending behaviour, responses revolved around either instant gratification (e.g. shopping) or long-term savings goals (e.g. buying a home)

When asked about challenges encountered when saving, responses centred on lack of knowledge in effective budgeting and lack of self-restraint in spending

When which bank the students hold account(s), there was a significant correlation between the bank used by the parents and that of the students

The students often receive money from their parents by way of either a monthly allowance or upon the completion of designated house chores, which they would then save in their piggy banks at home

Personas & Customer Journey Maps

We created 3 personas:

Emily, 43 years old (mother)

Sophie, 16 years old (Emily’s daughter)

Liam, 14 years old (Emily’s son)

From these 3 personas, we created 2 customer journey maps:

Emily and Liam (the interactions between Emily & Liam concerning Liam’s personal finances)

Sophie (life in a week of a 16-year-old teenager)

I predominantly worked on the end-to-end MVP of Emily and Liam.

As a team, we derived the following insights:

Major pain point: The lack of trust held by parents in their teenagers (under 16 years old) holding a debit card

Our opportunity: Educate teenagers about personal finances

Our opportunity: Educate teenagers about developing good financial habits and the value of money

How might we assist Liam and Sophie manage their personal finances as they navigate through high school?

How might we assist Emily in allowing Liam to hold a debit account, as well as track, educate and motivate Liam in his financial goals?

Develop

Ideation Workshop

The Ideation Workshop was facilitated via Zoom with the Westpac team. The purpose of the Ideation Workshop was to produce viable, desirable and useful solutions for Emily, Sophie and Liam.

One of my lo-fi ideas for the MVP was voted “highest impact, most feasible” by the Project Team during the dot voting. Because of this, I led the creation of the prototype and wireframing.

See below for the process of the ideation workshop and its outcomes.

Unique and Compelling Features of the MVP

Below is a summary of the unique and compelling features of the MVP.

Wireframes

These include the 3 personas’ frames:

Emily (parent, 43 years old)

Onboarding

Family banking hub

Set up task

Send rewards

Sophie (daughter, 18 years old) and Liam (son, 14 years old):

Customise wallpaper

Savings goal feature

Set up task

Rewards hub

Monthly summary

Deliver

Usability Testing

Usability testing was conducted through:

Guerilla testing

1-on-1 interview

Remote usability testing

Our test users comprised 11 Liams (12-15 years), 11 Sophies (16-18 years) and 3 Emilys (35-42 years). Key feedback from the usability testing included:

Sophies were reluctant in sharing information about their personal finances on social media

Since only 56% of Sophies would share their monthly wrap-up on social media, we added an option for Sophie to save their monthly wrap-up on the Westpac app or directly on their smartphone

Sophies and Liams found the process of creating a savings goal inefficient as this process required them to communicate with Wes, Westpac’s chat box (I addressed this pain point in my solo sprint below)

Liams questioned “Why can’t I add a goal on the Homepage?”. With that feedback, we added a ‘Set Goal’ function on the homepage in the final iteration

Solo Sprint

I undertook a solo sprint after the formal completion of the client project. During this solo sprint, I conducted another round of analysis into feedback from the usability testing in order to iterate an improved MVP and enhance the UI to ensure consistency with the Westpac brand.

Based on Liams’ and Sophies’ feedback, navigating the “Goal savings” feature was inefficient due to its chat box function. Therefore, during my solo sprint, I streamlined the feature to enhance its efficiency for Liam and Sophie by halving the number of steps required to create a savings goal

“Create Task” feature UI was redesigned to a slimmer layout, allowing Emily and Liam to easily view all their created tasks. UI has also been redesigned to ensure consistency with the Westpac brand

“Task Reward” and “Instant Gift” pop-up UI has been redesigned to ensure consistency with the Westpac brand

Emily’s Screen (Parent)

The new MVP features include:

“Family Banking” hub allowing Emily to have visibility over her children’s spending and activate spending limits

“Tasks” feature allowing Emily to approve and make payments for tasks (such as house chores) created and completed by Liam

“Instant Gifts” feature allowing Emily to celebrate Liam’s big and small moments in life when sending money to him through stickers and personalised messages

Liam’s Screen (Child)

The new MVP features include:

“Savings Goal” feature motivating Liam to be disciplined in his savings goals. This feature also allows for personalisation through Liam being able to select a preferred colour scheme (our research showed that Gen Z love product personalisation)

“Tasks” feature allowing Liam to create tasks (such as house chores) for payment that will be approved by Emily

“Mailbox” feature allowing Liam to receive messages from Emily and Westpac

“Hall of Achievements” feature storing Liam’s stickers and badges which he receives from Emily and Westpac every time he completes a task or achieves a savings goal

Sophie’s Screen (Child)

The new MVP features include:

“Monthly Wrap-up” feature allowing Sophie to track her spending habits in a fun way and giving her the option to share her big and small moments in life with her friends on social media

Next Steps

The next steps we would need to undertake before finalising the MVP are:

Conduct usability testing with more Emilys, Sophies and Liams

Conduct more research into the creation of a library of financial education with the purpose of helping parents teach children about personal finances

Add a notification in the “Onboarding” feature before the commencement of the chat that lists the documents required to open a bank account with Westpac

Results

80% of Emilys find “Family Banking” embedded in the onboarding process very helpful

“Family Banking” feature solved parents’ pain point in the lack of trust in their children holding a personal bank account and debit card. This feature allows parents to monitor their children’s spending using the “parental control” and “daily limit” features

58% of Sophies and Liams would use the “Goal Saving” feature

“Goal Saving” feature solved children’s pain point in struggling to save up. This feature boosts motivation while allowing the children to continually track their savings goal. This feature also enables children to develop skills in managing their personal finances while understanding the importance of saving up

67% of Liams would use the “Task” feature

“Task” feature solved parents’ pain point in their difficulty educating their children about the value of money. This feature allows youths to learn the lesson that hard work pays off

100% of Emilys find “Instant Gift” is easy to use and would use this feature when monetarily rewarding their children

“Instant Gift“ feature solved parents’ pain point in being unable to efficiently transfer money to their children. This feature saves parents’ time in transferring money to their children due to its intuitive and clear design. This is in addition to the feature’s unique and compelling experience in the sending of personal messages between parents and their children

Why are these features important for the business?

Customer retention and loyalty: The goal for Westpac is for it to be a person’s first bank and to build a life-long relationship with its customers. By assisting children in setting up their first bank account, with Westpac, it provides the bank the opportunity to build a life-long relationship

Increase user engagement: The new features allow users (children and their parents) to engage with the app as they are accomplishing their goals. Westpac wants to be there for their customers during life’s big and small moments

Customer satisfaction: Customer satisfaction is pivotal to customer retention. Thus, it is important the features on the app are optimised so as to drive user satisfaction on the app so that Westpac can retain users as life-long customers of the bank

Personal Takeaways

Some key personal takeaways from the project included:

Importance of UX design: The difficulties in educating young children about managing their personal finances, and a parent’s lack of trust in their children managing their own personal finances, can be solved through UX design[FW1] . As seen in this project, the “Parental Control” feature, which allows Emily to have visibility and control over Liam’s bank account, was rated 8.8/10 (average) in terms of usefulness by Emilys

Assumptions and biases: At the onset of the project, my preconceived assumptions and biases clouded my initial judgement on the MVP. However, as the project progressed and after analysing the data we collected, I was able to make decisions based on users’ needs as opposed to preconceived assumptions

Importance of usability testing in lo-fi: At the outset of the project, I focused much more of my efforts on UI as opposed to the flow of the early-stage prototype. Undoubtedly, focusing more on UX as opposed to UI during the lo-fi stage drove greater efficiency in the team as we progressed to the subsequent stages of the project